Your secure access

Blue Vision, SME, Mortgage and Tangible plans, and Blue Choice suite.

Contact us: Travel, Health & Life Insurance

This FAQ was created to help you support your clients during the COVID-19 pandemic. Even if our local offices are currently closed, the necessary solutions have been put in place to ensure the good continuity of our services. Our sales team remains available to offer you the support you need.

Last update: March 26, 2021

REMUNERATION

R1. Effective April 1, 2020, we are postponing charge backs of commissions due to cancellations or lapses received as of this date, for a period of 60 days.

ADMINISTRATION

R1. In the current context, the relief measures below are offered for the reinstatement of contracts cancelled between March 11, 2020 and July 31, 2020. These will temporarily replace our standard rules.

Reinstatement (depending on the length of time since the effective cancellation date).

- Less than 6 months ago: Declaration of good health form confirming that health has remained unchanged since the cancellation of the contract.

- Extended Health and Dental Care benefits: reactivation without payment of retroactive premiums

- All other benefits: reinstatement with payment of retroactive premiums

- As of 6 months, but less than 12 months ago: reinstatement with payment of retroactive premiums

- Products requiring underwriting*: Complete Health declaration form with Additional health declaration form due to COVID-19.

- Products without underwriting: declaration in the new application

- As of 12 months of: new application

* Including Association Program and SME Plan

We would like to remind you that, in the event of a reactivation or reinstatement, your clients may not submit claims retroactively for any events that occurred, or any services obtained during the period when their contracts were no longer in effect.

The health declaration form as well as the additional health declaration form due to COVID-19 are all available on the Advisor resources section of the Website.

R2. Yes. The necessary measures have been put in place to ensure that all our services are maintained and to meet our usual claims processing times. Our Info-Partners, Commissions and Contracting, as well as our sales directors remain available by phone or by email.

For the time being, if you have any documents to send us, please send them by email

For any requests related to administration or medical underwriting, please contact:

Info-Partners Health :

- Info.partners.health@ont.bluecross.ca

- 514-286-2626 or 1-800-361-2538 (option 2, then option 1)

For any questions related to your commissions, please contact:

Commissions and Contracting

- Commission.contracting@ont.bluecross.ca

- 514-286-2626 or 1-800-361-2538 (option 2, then option 2)

Contact our sales directors:

GTA & Eastern Ontario

Bill Walker

Senior Account Executive - Brokerage Channel

416-986-3683

Bill.Walker@ont.bluecross.ca

GTA, Southwestern Ontario & Golden Horseshoe

Roy Ehlermann

Business Development Manager

416-318-1462

Roy.Ehlermann@ont.bluecross.ca

GTA & Northern Ontario

Max Mahardi

Business Development Manager

416-802-9814

Max.Mahardi@ont.bluecross.ca

R3. If your client is experiencing financial difficulties as a result of the crisis, contact Info-Partners or ask them to call our customer service department at 1-888-822-2583 to take the necessary measures for the payment of their premiums and avoid having their financial institution charge them a fee for insufficient funds. We will be able to offer them a 90-day period to pay their premiums. During that time, their coverage will be maintained. Following this 90-day period, we will apply the terms of the agreement taken with your client.

If your client fails to call us before the expected date of their payment, our usual rules apply.

In addition, after the 90-day payment period, we offer your client the possibility to spread their premium payments over a period of up to 6 consecutive months, without any interest charges. Please contact our customer service department to review the payment terms.

R4. No. The COVID-19 vaccine does not affect your client's health insurance policy, new insurance application or current claims.

R5. We accept the following methods of payment for the initial premium:

- Credit card

- Pre-authorized debit (PAD)

Payment by cheque is no longer accepted at this time

R6. Yes, we can deliver the insurance application as well as the requirements for your contract to take effect electronically. Please email your request to Info.partners.health@ont.bluecross.ca.

R7. Yes. We accept insurance applications signed remotely (i.e. without the physical presence of the client) and delivered electronically. Please note that you will be required to also send a copy to your general MGA.

R8. We accept the following documents through our file dropbox page:

- Insurance applications

- All documents required for delivering the contract

- Forms

All scanned documents must be clear and legible. Please send them through our file dropbox page.

R9. We accept the following signatures:

- Handwritten signature (pen or stylus) and sent electronically

- Adobe Sign, DocuSign, OneSpan, EZSign, Authentisign or NexOne Sign electronic signature with the authentication certification

R10. We will temporarily accept insurance proposals, change requests and setting requirements without the witness signature.

R11. As of the month of May, for a three-month period, we are offering:

- 50% reduction on the dental care benefit monthly premium

- 20% reduction on the extended health care benefit monthly premium

No action on your part or your client’s is required. This reduction will be automatically applied to the accounts of all clients who have enrolled in the benefits mentioned above.

The latest reductions were applied to the accounts of eligible clients on June 29, 2020.

Also be advised that we will not apply retroactive charges to your commissions despite this premium reduction.

UNDERWRITING

R1. Insurance requests from clients returning from a trip outside the country will be put on hold for two weeks from the date of their return. A health declaration will also be required upon delivery of the contract.

Insurance requests from clients who are planning to travel outside the country within the next months, while a government-issued advisory to avoid all travel is in place, will be postponed until their return to the country. They will have to comply with the medical requirements in place at this moment.

R2. Our providers are gradually resuming their paramedical services. However, we will continue to offer the following two options to give your clients more flexibility:

- Maintaining the initial insurance amount. As insurance requests were deferred during the crisis, we will ask for paramedical services if necessary since they are now available again.

OR

- Select a lower insurance amount requiring only a phone interview as a medical underwriting requirement. In this case, your client must complete and sign a form to confirm they accept the change. To get this form, please write to Info.partners.health@qc.bluecross.ca.

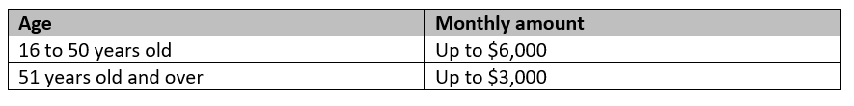

R3. We have created a new temporary medical requirements table necessitating only a telephone interview:

This table applies retroactively to any insurance application under analysis since March 15, 2020 for the Disability due to Illness and Overhead Expenses benefits of the Blue Vision product and the Disability benefit of the Mortgage Plan. We will re-evaluate all pending requests.

R4. We are temporarily accepting the health declaration form combined with the additional health declaration form due to COVID-19. You will find these documents in the Advisor resources.

CLAIMS

R1. To be eligible for disability payments, your client must:

- Have been diagnosed with a COVID-19-related infection.

AND

- Meet the disability definition of their insurance policy.

If your client is eligible, the waiting period before they receive their payments for disability benefits starts on the first day they were placed under quarantine.

To submit a disability claim, your client must follow the steps on our website.

R2. The necessary measures have been put in place to meet our claims processing times. However, because we are experiencing longer than normal turnaround times to receive the medical documents required, claims could be delayed. Thank you for your understanding and your patience.

For the time being, we ask that all our clients send their claims through our file dropbox page or by fax.

Claims Health insurance products :

- File dropbox page

- 1-866-286-8358

Claims Life and disability insurance products :

- File dropbox page

- 1-877-590-7504

R3. Yes, we are accepting claims for consultations carried by phone or video chat with the following medical practitioners (if they are covered by the client’s contract):

- Audiologist or audioprosthetist

- Chiropractor

- Nutritionist or dietician

- Occupational therapist

- Naturopath

- Speech and language therapist

- Physiotherapist or Physical rehabilitation therapist

- Podiatrist or chiropodist

- Psychologist

This measure will be maintained even after the COVID-19 crisis.

TRAVEL INSURANCE COVERAGE

R1. Yes, as of July 22, 2020, it is possible to purchase the travel insurance coverage offered with the Express Plan.

R2. Our travel insurance FAQ was recently updated to reflect government measures relating to COVID-19. Please refer your client to this FAQ to read about the rules that apply to annual travel insurance, offered with the Express Plan.